The credit rating, the cashback, the checking account and the credit account... what are they? Don't panic, we explain it all to you!

The Canadian banking system is slightly different from the system we are used to in France or Belgium. We therefore offer you a presentation of its specificities to help you familiarise yourself before your arrival!

The Canadian banking system: the different bank accounts

When it comes to bank accounts in Canada, there are two main options: chequing accounts and savings accounts.

The chequing account

A chequing account is an account used to manage your money on a daily basis. It is also known as a transaction account, bank account, deposit account or current account. This is the type of account where you normally have a debit card and/or a checkbook.

In France, this type of account is often referred to as a current account where your daily banking activities are carried out.

This is the account where you will be able to deposit your salary in Canada via a specimen check (RIB in France).

The savings account

Conversely, the savings account is an account that earns interest on the money you deposit in it. It allows you to save for your future.

So far, it doesn't seem much different from the French system, does it? Well, in Canada, you also have what is called a credit card account.

The credit card account

This account is directly linked to your Canadian credit card . This account will need to be paid back regularly to avoid paying interest! It will contain all transactions paid with your credit card.

The Canadian banking system: the different bank cards

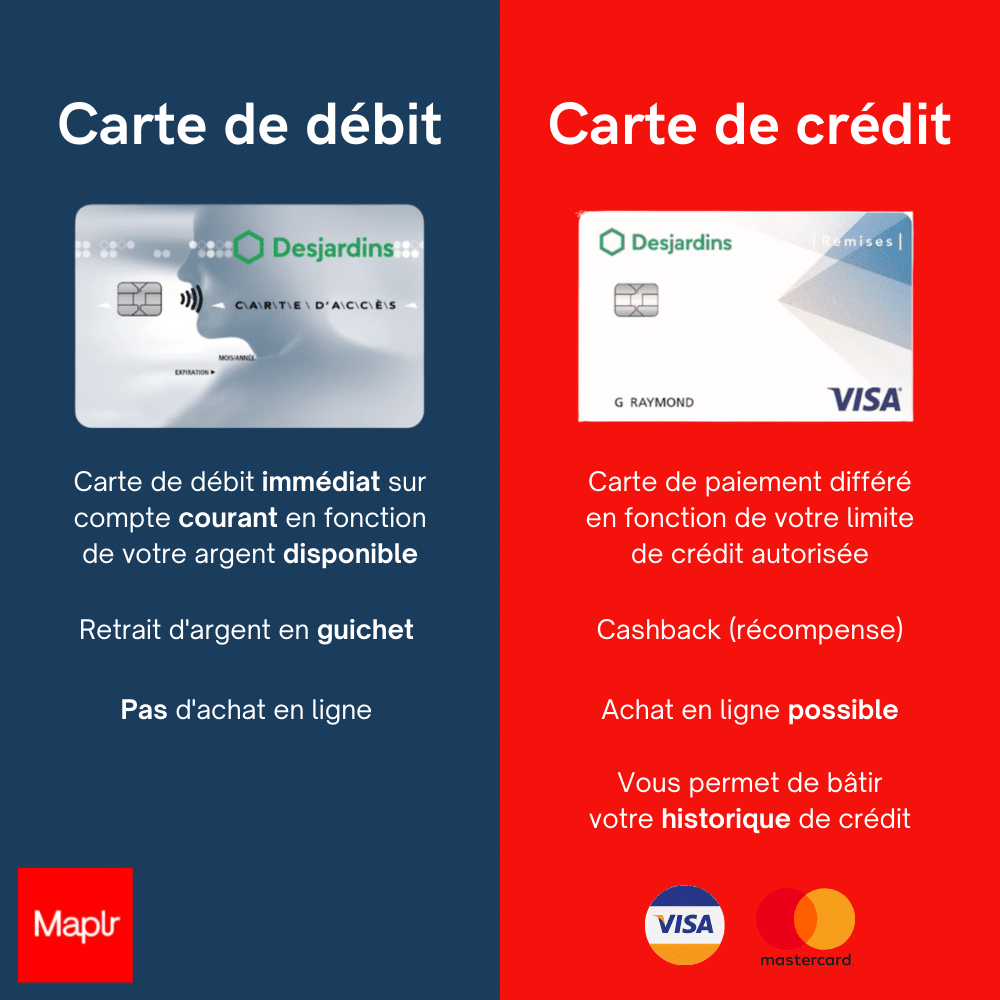

In Canada, it is normal to have two types of card: a debit card and a credit card. debit card and a credit card. These are two separate cards and entities.

The debit card

When you open your Canadian bank account, you will automatically receive a debit card (also known as an Interac Card).

This card allows you to make transactions that will be debited immediately from your chequing account. It will also allow you to withdraw cash from ATMs to the same account. The debit card does not have a security code on the back of the card and therefore will not allow you to pay on the internet.

The credit card

On its side, a credit card is linked to a separate account (credit card account) that allows you to make purchases (e.g. online) that must be repaid on specific dates. It is a type of short-term loan: you make a purchase and the credit card issuer lends you the amount (based on your credit limit) to pay for that purchase. You must then pay the card issuer (Visa or Mastercard) back on a monthly basis.

Having a credit card is a very common practice in Canada and is very important in the Canadian banking system. It allows you to get a cash advance, establish a credit history and build a good credit rating. In the long run, a good credit rating makes it easier to buy a house or a car and to sign a lease, as a credit check will be required.

Be careful! Don't forget the interest you have to pay if you don't pay your credit card balance on time (this varies depending on your financial institution).

The Canadian banking system: the benefits of your Canadian credit card

Your new Canadian credit card will give you access to certain benefits.

Cashback or rewards

The banking system in North America allows you to get what is called cashback.

"Euuuu... the cash what?"

Cashback is a principle of "return on purchase". When you buy with your credit card, the bank will give you a return on your purchase. Some banks call it a rebate or a reward; this return will be done by reimbursing a percentage of your expenses. Depending on the type of credit card you have, the rate of return will be higher or lower. Quite interesting, isn't it?

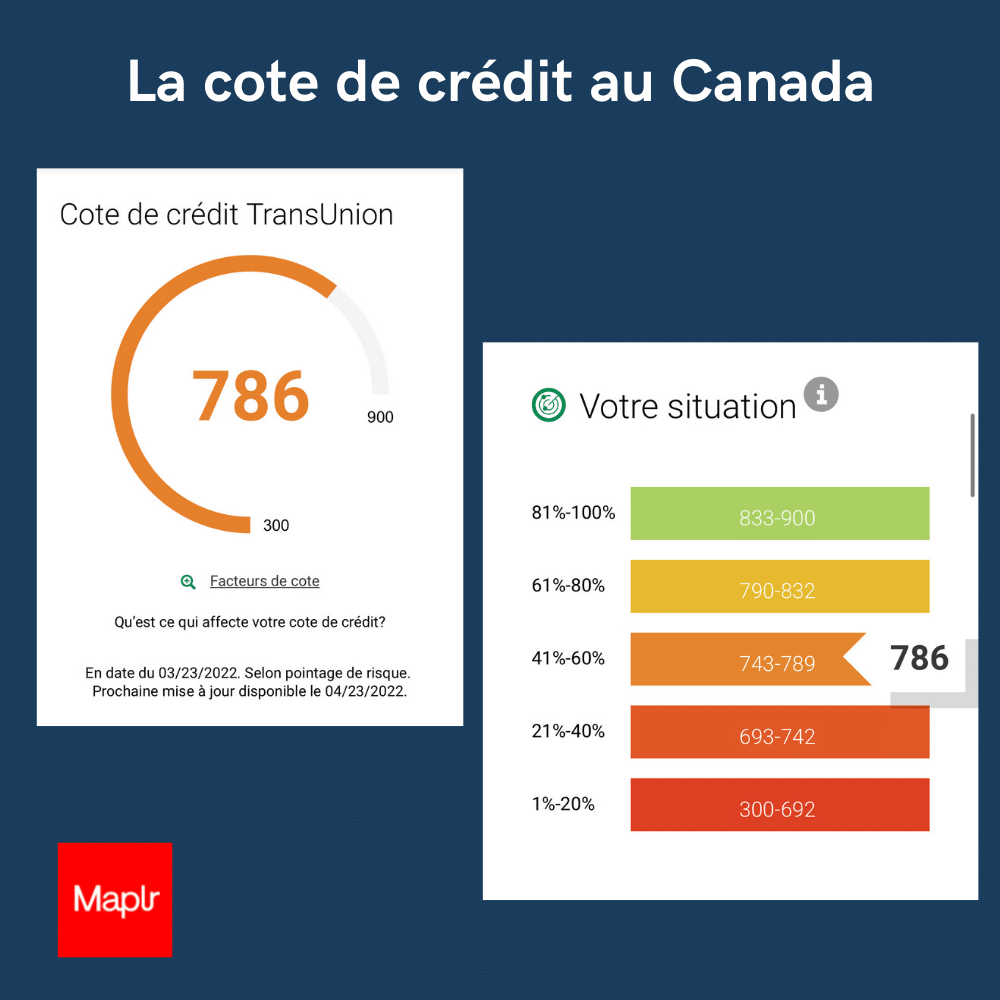

Shape your credit rating

As mentioned above, your credit card will help you build your credit rating. Your credit rating is a way to check your creditworthiness. Today, it is the only way for Canadian financial actors to check it.

➡️ A credit score is an assessment of your credit history. Simply put, a mathematical algorithm will analyse your ability to manage the credit assigned to you and quantify your risk level with a number!

If you pay your credit account regularly and correctly from your banking application, then your credit rating will be good. The better your credit rating, the higher your authorized credit limit can be.

As a newcomer, your authorized credit limit will depend, in part, on your salary. While your authorized limit may not be very large when you first arrive, it can grow over time as long as you pay off your credit account regularly.

It will be useful if you want to buy a property or a car, for example. It may also be required when renting an apartment.

Are you a newcomer?

Don't worry, you won't be asked for your credit rating when looking for a new apartment, landlords know that you haven't been able to create one yet and are very understanding most ofthe time.

If you want to know more about renting an apartment in Montreal, you can find more information in our article Finding a place to live in Montreal: our advice and tips for expatriates.

Maplrs' advice for a good credit rating

Pay off your credit card account regularly

Wait at least 6 months before requesting an increase in your authorized line of credit

Spend a maximum of 30% of your authorized line of credit or pay it back more regularly!

Set reminders so you don't forget to pay back your credit card!Marion

Co-founder of Mapl

The Canadian banking system: Bank transfers

Another common practice in Canada is Interac transfer.

It's a simple and secure way to send money to someone, by text or email in 1 minute flat, regardless of their bank!

It is therefore an alternative to cheques or ATM withdrawals. All you need is a Canadian bank account and the phone number or email address of the person you want to send money to.

The differences in vocabulary between the Canadian and French banking systems

To help you in your new life in Canada, here is a summary of the differences in vocabulary between France and Canada.

| France | Canada |

| GNI | Specimen cheque or bank draft |

|

Credit card / Blue card (the term "credit card" is often used incorrectly) |

Debit card / Interac card |

| No equivalent | Credit card |

| Cash | Cash |

| A way to send money to someone, by text or email | Interac transfer |

| Return on purchases made by your credit card account | Cashback / rewards |

The cost of living in Canada

To continue learning about finances in Canada and because you are planning an expatriation to this beautiful country, we recommend you to find out now about the cost of living in Montreal.

Did you like this article? Don't hesitate to share it

on social networks 👍