📅 Last updated on February 22, 2023 at 12:00 PM (Montreal time)

Travel insurance for Canada is mandatory for holders of an EIC permit (PVT, Young Professional...).

The immigration officer may shorten the duration of your work permit if your insurance certificate is not two years. Only for young professionals who have access to the RAMQ, travel insurance covering health expenses is duplicated with group insurance offered by your employer.

Don't forget to read beforehand the complete article about the health care system in Canada.

Travel insurance Canada PVT: why is it mandatory for your immigration?

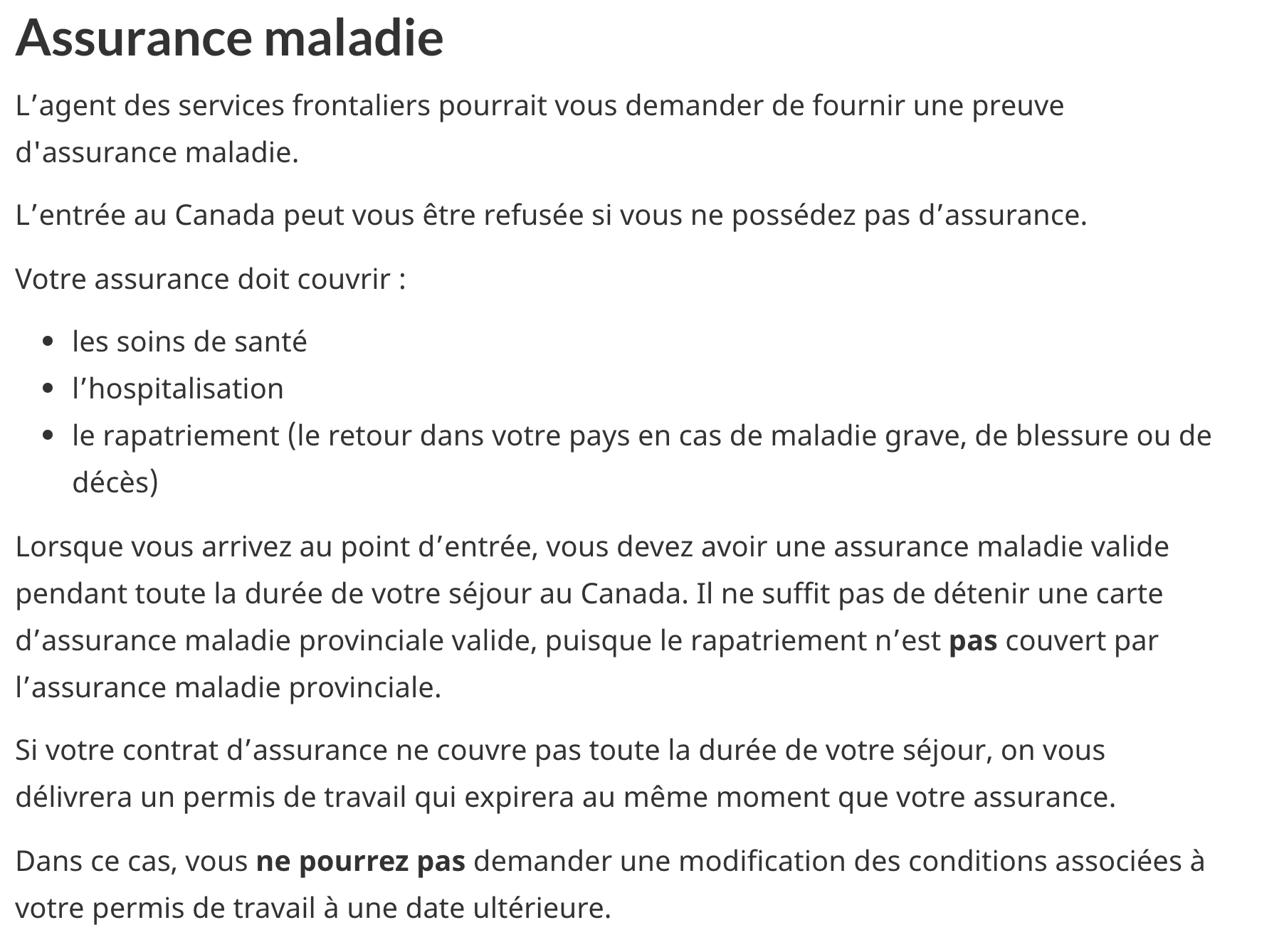

To go to Canada under the EIC program (PVT, young professional...etc), health insurance (or travel insurance for Canada) covering your entire stay is mandatory. Indeed, it will cover you for repatriation, hospitalization and urgent or unexpected illnesses: things required by immigration for the delivery of your work permit. Here is an extract from the official website :

Thus, for closed permits (JP, VIE, EIMT/CAQ) health care and hospitalization will be covered by the RAMQ but not the repatriation.

Repatriation As repatriation is compulsory to enter the country, you must have travel insurance covering repatriation to Canada.

Travel insurance Canada PVT: possible solutions

For holders of a WHV

Pvtists (holders of a vacation-work permit for Canada) who are not entitled to RAMQ (Régie d'assurance maladie du Québec) must take out travel insurance to benefit from the reimbursement of health care and hospitalization . Indeed, as indicated in the the article dedicated to the health care system in Canadahealth care can be very expensive without insurance. Unfortunately, it will be impossible for you to save money on your health insurance in Canada.

For holders of a closed permit (young pro, VIE or EIMT/CAQ)

For holders of a closed work permit with a Canadian employer, are eligible for the health insurance of the province of residence and thus their health and hospitalization expenses will be reimbursed by the public system. You will understand that your travel insurance will be "doubled" for certain reimbursements (after the 3-month waiting period).

Take out insurance for repatriation only via your bank cards

Some people think they can take advantage of their premium credit card insurance (Visa Gold...) which contains repatriation insurance. However, these cards generally only offer repatriation for trips of less than 90 days and only if you have purchased your airline tickets with the card in question. Unfortunately, as far as we know, no travel insurance company offers repatriation exclusively.

Credit card insurances are not adapted for an expatriation via the EIC program (Pvt, young pro...). A travel insurance for your departure to Canada is therefore mandatory!

Canada PVT travel insurance: our tip to save with Chapka!

Maplr is proud to be a partner of ChapkaChapka Maplr, a leading player in international mobility, offers insurance solutions to protect your health abroad.

Why choose Chapka for your travel insurance for Canada?

- Your emergency medical expenses will be covered (sudden and unexpected illness). From the first euro.

- Benefit from a worldwide coverage for your vacations of less than 90 days and a coverage in France for your trips of less than 30 days.

- You can also purchase this travel insurance for Canada if you have a Young Professionals permit or International Co-op permit (all permits in the EIC program).