Last updated on February 22, 2023 (Montreal time)

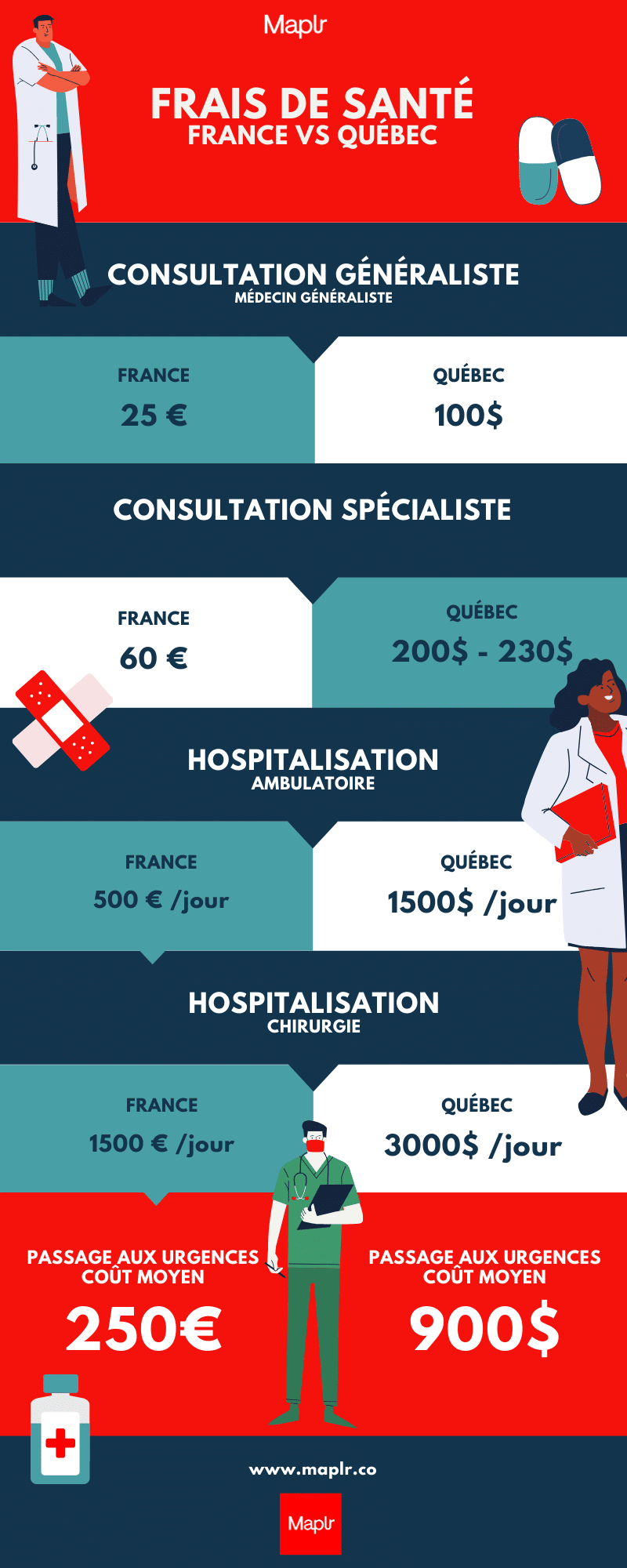

Canada's health care system is among the best health care systems in the world. It stands out from its American neighbor. This is certainlyone of the of the many reasons why francophones from all over the world decide to settle here.

Canada has many modern infrastructures and many renowned specialists providing high quality care. Despite the quality of Canada's universal health care system, it has had to adapt to the changing needs of the population. Seeing a doctor can be very costly if you are not well insured. Familiarize yourself with Canada's health care system and the insurance requirements for your WHP or young professional expatriation.

Health care in Canada & WHP: Health insurance, drug insurance and group insurance: what you need to know

Health insurance

The Quebec Health Insurance (RAMQ) is the equivalent of the French CPAM. It covers routine medical care, expenses related to physician consultations and basic hospital services.

As a result, some care is not covered, such as

- Consultations in private clinics

- Dental and optical care (except in special cases)

- Alternative medicine (acupuncture, dietician, naturopath...)

- Doctors and practitioners who do not accept RAMQ

Group insurance

Group insurance (equivalent to a mutual insurance company in France) is a private insurance. Often offered by employers, this insurance will reimburse expenses not covered by the public system (dental, optical, massage therapy...).

Prescription medication coverage

Drug insurance is mandatory and covers expenses related to the purchase of prescription drugs. In fact, drugs are not free and you will have to pay a portion of them (your contribution). When you register with the RAMQ for the first time, you are also registered for drug insurance.

Please note that if you have private group insurance (for example, through your employer or your spouse's employer), the drug insurance is covered by this private insurance plan. Therefore, you will have to notify the RAMQ in order to deregister from the public system and not have to pay this part twice.

Health care system in Canada: how the health care system works in Quebec

In order to benefit from Canadian public health services, you must be affiliated with the Quebec health insurance plan: the Régie de l'assurance maladie du Québec (RAMQ). Please note that these services are reserved for Canadian citizens, permanent residents and holders of certain work permits valid for more than 6 months (e.g.: young professional permit, open permit attached to a closed permit...).

Pvts with an open work permit (not attached to a closed work permit) are unfortunately not eligible. You can consult here the eligibility requirements.

It should be noted that there is a 3-month waiting period before you are eligible for RAMQ . This period is also called the " waiting period ".

An agreement with France has been put in place to avoid the 3-month waiting period: you will have to fill out the form for the totalization of periods of maternity insurance called the SE 401-Q-207. Once you are affiliated with the RAMQ, you will lose your rights to your health insurance in your country of origin (e.g. CPAM).

Therefore, to obtain the form you must make an appointment at the International Relations Department of the CPAM.

Health care system in Canada: why buy insurance before you leave on a WHP or Young Professional Program (YPP)?

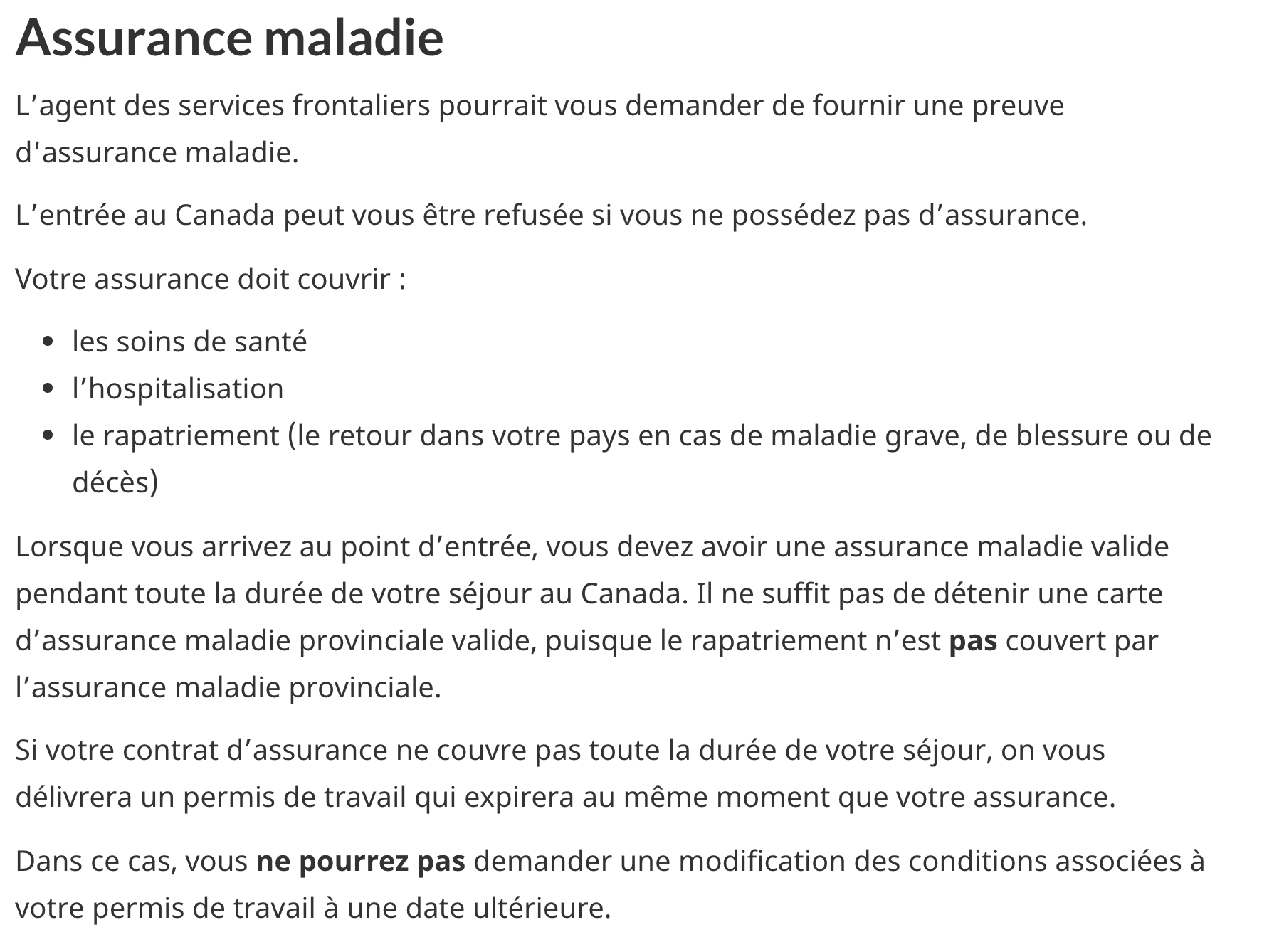

In order to go to Canada under the EIC program (PVT, young professional...etc), an international health insurance is mandatory. Indeed, it will cover you for repatriation, hospitalization and urgent or unexpected illnesses.

If you do not have this document, the Canadian authorities may refuse you access to the country. The certificate must be for the same duration as your work permit. Therefore, if you decide to take out insurance for a period shorter than that of your work permit, you could also be refused entry or have your entry shortened by the same amount of time as your insurance certificate. Here is an excerpt from the official website:

As you can see, health care and hospitalization will be covered by the RAMQ (if you are entitled to it according to your licence) but not repatriation.

Repatriation As repatriation is compulsory to arrive in Canada, you must have travel insurance covering repatriation to Canada.

Canada's health care system: travel insurance for peace of mind

Health insurance is imperative to allow you to enter the country, but also in case something happens to you during the waiting period or after depending on your work permit.

Health system in Canada & WHP: how to protect your health in Canada?

Travel insurance Chapkais a reference actor that offers insurance solutions to protect your health abroad. Ainfi to accompany you to Canada, Cap Working Holiday, from Chapka will be the perfect solution for your departure via the EIC program.

Exclusive MAPLR partnership:

Get 5% off your travel insurance!

Did you like this article? Don't hesitate to share it

on social networks 👍