When you plan to go to Canada under the EIC program (PVT, young professional...), a travel insurance for Canada is mandatory to cover your entire stay.

That's why many travelers turn to Chapka travel insurance to go to Canada.

You can read thefull article on immigration and travel insurance requirements to make sure you meet all the requirements before you expatriate.

Why is it important to have travel insurance to go to Canada?

Having travel insurance for Canada is crucial for several reasons. First of all, in case of illness or accident, travel insurance can cover medical expenses, including repatriation, which can be very high in Canada.

If you become ill, injured, or have to return to your home country to accompany a sick loved one, it can be very expensive and Chapka can intervene at these times.

Even if you have a group insurance policy with your employer, it is important to note that there may be a waiting period before the coverage takes effect. This waiting period can vary and can generally be up to three months. This means that during this period, you will not be covered in case of a medical emergency.

For holders of a closed permit (Young Pro, VIE or EIMT/CAQ)

For holders of a closed license, it is important to know that the waiting period with the RAMQ (Quebec Health Insurance Plan) is three months. This means that you will not be covered by the public health insurance plan during this period.

Canadian authorities can refuse you entry

It is also important to note that Canadian authorities may refuse entry or shorten your visa if your travel insurance does not cover your entire stay. It is therefore essential to take out travel insurance, such as Chapka, that covers your entire stay in Canada to avoid any problems at customs.

Save with Chapka travel insurance for your trip to Canada

Our partnership with Chapka travel insurance

Since the inception of Maplr, a collaboration has been established with Chapka to provide our Maplrs with comprehensive and reliable travel insurance solutions. We recently conducted a survey and found that several members of the Maplr community have subscribed to their services and are very satisfied. We are very confident in the quality of Chapka's services and we know that they offer very good travel insurance options for expatriates in Canada.

As part of our partnership with Chapka, a 5% discount discount is offered when you purchase Chapka travel insurance for Canada.

We hope that this collaboration will allow you to travel to Canada with peace of mind.

Chapka travel insurance for Canada specifics

Cape Working Holiday

To accompany you to Canada, Cap Working Holidayfrom Chapka will be the perfect solution for your departure via the EIC program.

Here is a quick overview of how Cap Working Holiday can accompany people on a Working Holiday Permit (WHP), Young Professionals (YP) and International Co-op in Canada:

👉 Comprehensive medical coverage

You are insured at 100% and unlimited in case of unforeseeable accident or illness.

👉 24/7 medical teleconsultation

Consultations on Med&Vous are free. The teleconsultation is equivalent to a consultation with your doctor.

👉 Presence of a relative in case of hospitalization

A round trip ticket as well as hotel expenses will be possible for one of your loved ones.

👉 Early return

In the event of serious hospitalization or death of a loved one, you can benefit from an early return, at actual travel costs . This also applies to your grandparents.

👉 Insured worldwide

You are insured for your stays of less than 90 days and have coverage in France for your trips of less than 30 days.

And also:

- Basic guarantees: trip cancellation, repatriation, luggage insurance, civil liability.

- Coverage for sports activities and winter sports.

- French-speaking assistance available 24 hours a day, 7 days a week

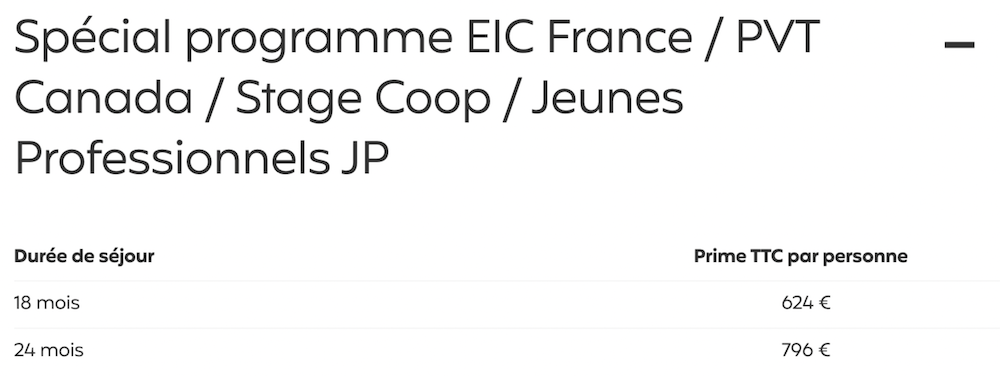

To give you an idea of the rates in effect for 2022-2023, here is an official excerpt from the Chapka travel insurance site for Canada:

It is possible to spread this fee over three installments.

Testimonials from Maplrs who have signed up for Chapka travel insurance

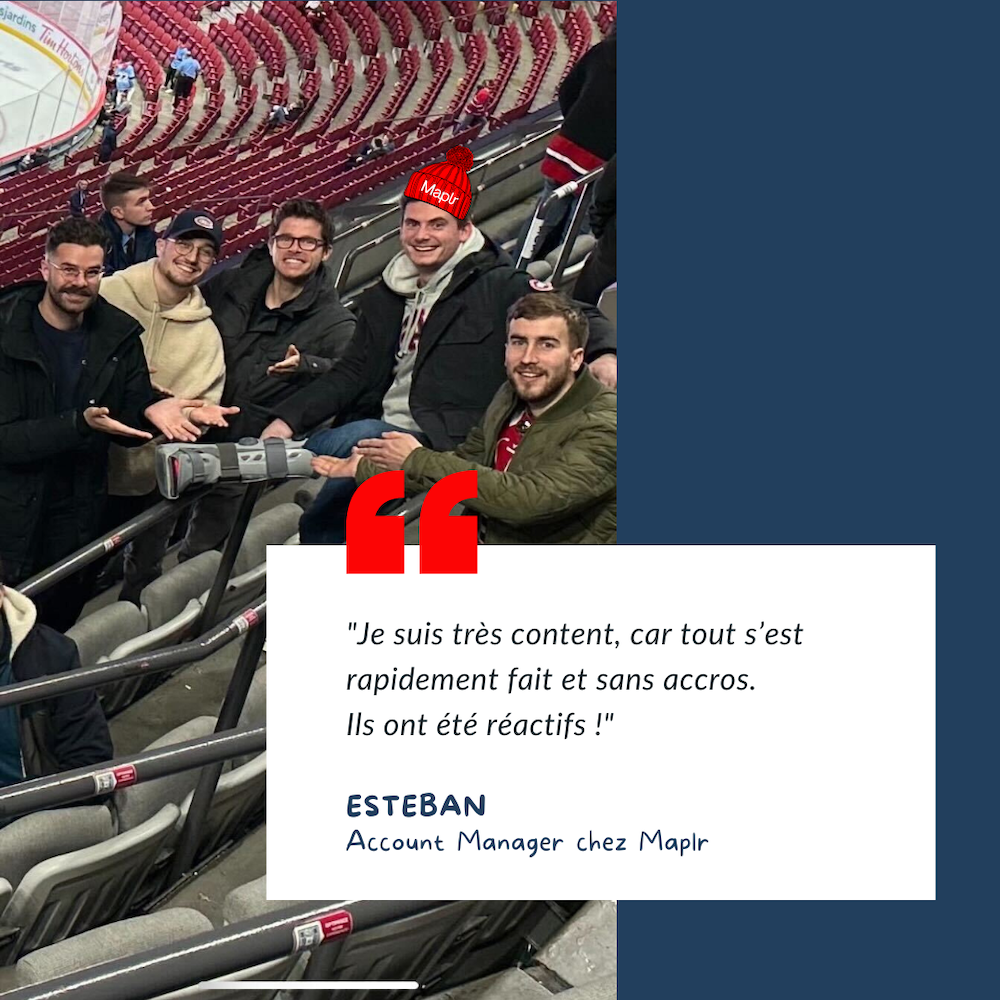

Esteban, a Maplr on a young professional license who moved to Montreal, shares his experience with Chapka travel insurance following a major injury.

Esteban was injured playing soccer a month and a half after arriving in Montreal. He had to go to the hospital and have emergency surgery. The first thing he had to do was to contact Chapka for assistance . "Chapka offered me two solutions: repatriation or surgery on site, it was up to me to choose.

"I'm very happy, because everything went quickly and smoothly. They were responsive!"

In fact, Chapka covers 100% of the cost of repatriation to your country of origin. Esteban decided to stay in Montreal and have surgery there. The French-speaking assistance was able to guide him through the steps to follow and explain the entire procedure.

During a hospitalization in your country of expatriation, Chapka will provide a return ticket for one of your relatives as well as a cover for hotel expenses in order to be at your side. This is an unexpected benefit, but one that can be reassuring when you are far from your family at such times.

We asked Esteban for advice on how to best handle an emergency situation like his,

" I advanced the cost of follow-up appointments and paid the surgeons and anesthesiologists before the operation. I was reimbursed one month after validation and sending the supporting documents. Honestly, I'm very happy because everything was done quickly and smoothly. They were reactive.

You absolutely have to keep everything from the moment you pay for something, as they are picky about receipts."

All proof of payment will be required at the time of claim. Your medical expenses will be covered without deductible. But be careful, your health expenses will only be covered in case of sudden, unforeseeable illness or accident as in the case of Esteban.

Strengths and weaknesses of insurance according to the Maplrs 🚀

We went to get testimonials directly from 20 Chapka policyholders we know!

🟢 Strengths according to Maplrs:

- A prescription can be issued after the teleconsultation

- Quick and full refund from them

- Repatriation covered at 100%.

- Possibility of payment in 3 instalments

- There is a good follow-up and they are reactive

🟠 Weaknesses:

- Does not cover pre-contract illnesses

- Many documents are required

- Only one repatriation due to death is covered

- Advance payment of certain expenses

Indeed, insurance is the pooling of risk. Chapka is there to support you and help you in case of emergency during your expatriation.

Tips for choosing travel insurance based on your needs and budget 💸

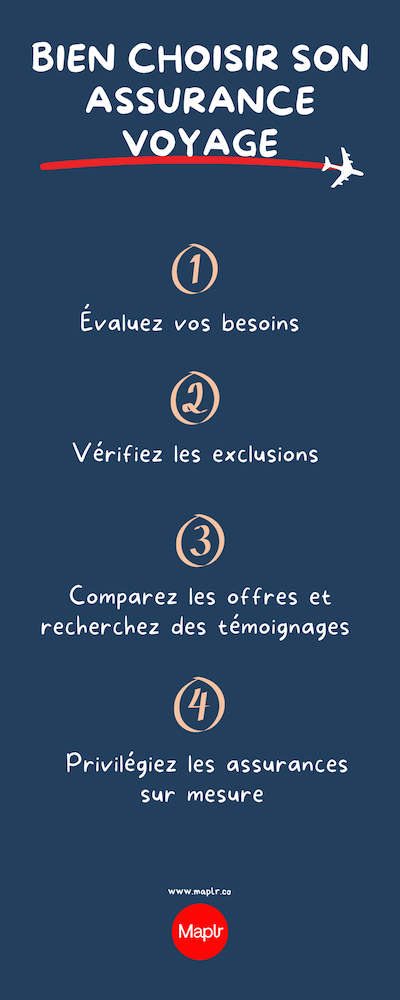

1️⃣ Assess your needs: Before you purchase travel insurance, take the time to assess your coverage needs. Depending on your destination, the length of your stay, your activities there and your health, you will need specific coverage.

2️⃣ Check for exclusions: Carefully read the terms and conditions of your travel insurance policy for any exclusions of coverage. Some insurance policies do not cover extreme sports or pre-existing conditions.

3️⃣ Compare offers and look for testimonials: To find the best travel insurance, don't hesitate to compare offers from different insurers and take into account testimonials from people who have already expatriatedwith them.

4️⃣ Choose customized insurance: Some insurances offer customized packages adapted to your specific needs. For example, if you are traveling with children and need specific care.

Maplr takes to heart the accompaniment of its team members for a successful expatriation!

Health, finding accommodation, finance... so many subjects that are addressed during your expatriation.

So, if you too work in tech and want to join Maplr, you can sign up for our coaching program 👇